28+ Lifetime mortgage calculator

Once the user inputs the required information the Mortgage Payoff Calculator will calculate the pertinent data. 3 Aug 2022 445pm.

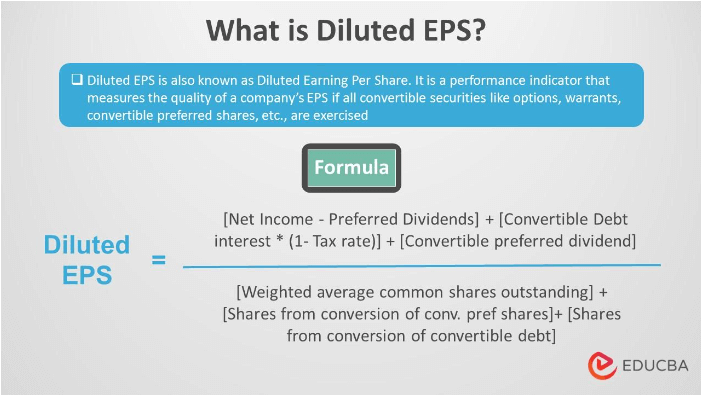

Diluted Eps Earnings Per Share Meaning Formula Examples

More on Equity Release Service.

. Its one of the most expensive major purchases youll make in a lifetime. The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. By default this calculator uses a 28 front-end ratio housing expenses versus income a 36 back-end ratio monthly housing plus debt payments versus income though these are variables in the calculator which you can adjust to suit your needs the limits set by your lender.

The most common mortgage term in Canada is five years while the most common amortization period. Our fixed-rate mortgage calculator can help you figure out if a 15-year or 30-year mortgage is a better match for both your current financial situation and your future earnings. Or one could have a 228 or 327 ARM.

If you are shopping for a home be sure to research property tax and insurance rates in the area and include those in your final. The suggested limit for a car payment is normally no more than 20 of your take home income note the distinction. Calculator Rates 7YR Adjustable Rate Mortgage Calculator.

For today Saturday September 17 2022 the current average 30-year fixed-mortgage rate is 628. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year. There is a difference between amortization and mortgage termThe term is the length of time that your mortgage agreement and current mortgage interest rate is valid for.

You have a lot of loan options as a homebuyer but fixed-rate mortgages are the most commonly used. Many experts suggest that a house payment should be no more than 28-33 of your total income. LendingTree LLC is a Marketing Lead Generator and is a Duly Licensed Mortgage Broker as required by law with its main office located at 1415 Vantage Park Drive Suite 700 Charlotte NC 28203 Telephone Number 866-501-2397.

February typically has 28 days except on leap years when it has 29 days. If you are paid an even sum for each month to convert annual salary into monthly salary divide the annual salary by 12. Use our mortgage calculator.

January March May July AugustOctober and December have 31 days while February April June September and November have 30 days. Learn more about the lifetime mortgage calculator. And for most people it can take decades to pay down a mortgage.

We update our interest rate table daily Monday through Friday so you always have the most current information on hand. 2836 are historical mortgage industry standers which are. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

The mortgage amortization period is how long it will take you to pay off your mortgage. Maximum is 50 with compensating factors. Our competitive mortgage rates are backed by an experienced staff of mortgage professionals.

28 Mar 2022 515pm. It aims to provide support for eligible Australian home owners at pension age even if they are not taking a pension in the form of a fortnightly income stream by taking out a loan against the equity in their homeIt is a reverse mortgage. With this format the first number tells you how long rates are fixed for the second number tells you how many years the loan will adjust for.

Most lenders prefer 28. Aside from selling the home to pay off the mortgage some borrowers may want to pay off their mortgage earlier to save on interest. The maximum amount the loan interest rate is able to increase throughout the.

The Home Equity Access Scheme formerly known as the Pension Loan Scheme PLS is a federal government reverse mortgage scheme.

Loan Servicing How Does Loan Servicing Work With Example

Loan Amortization Calculator Excel Tool Excel Template Etsy In 2022 Excel Templates Amortization Schedule Basic Computer Programming

Mortgage Bank How Does A Mortgage Bank Work With Example

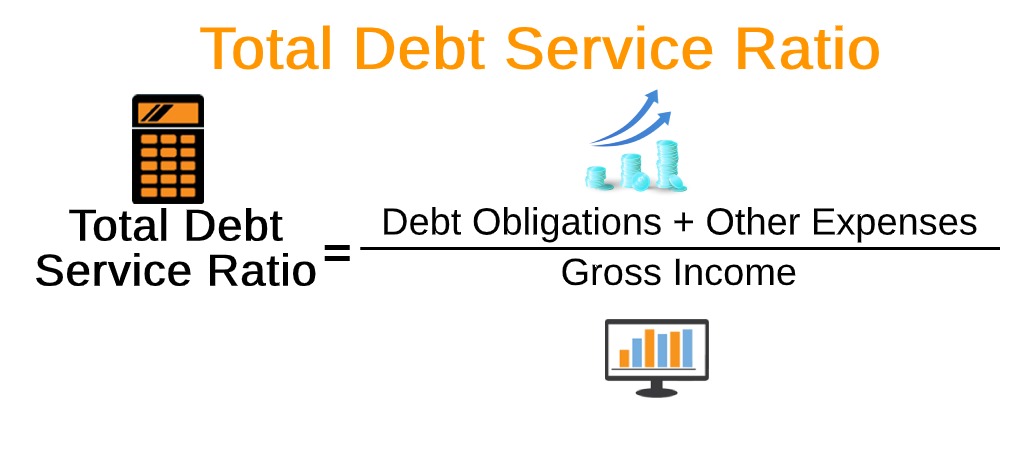

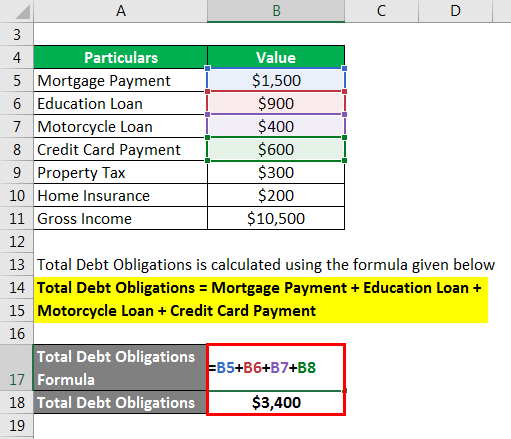

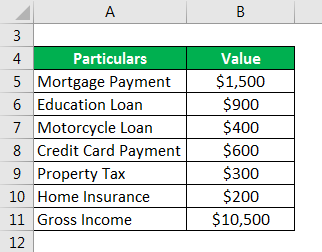

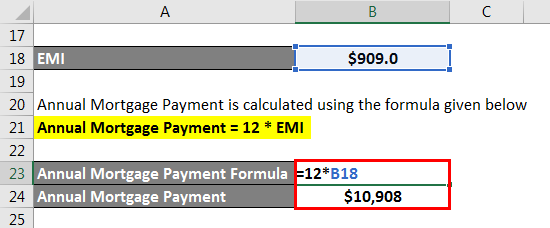

Total Debt Service Ratio Explanation And Examples With Excel Template

This Flyer Illustrates How Your Purchasing Power Lowers As Interest Rates Rise Interest Rates Purchasing Power Interest Rate Rise

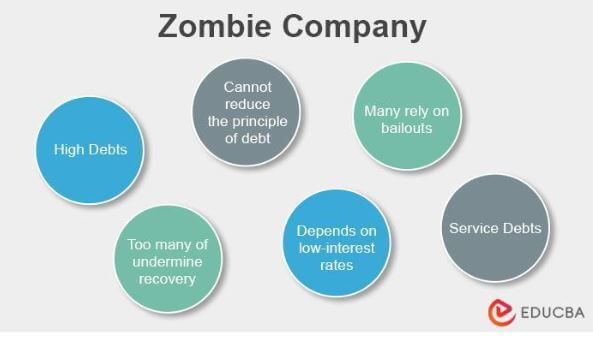

Zombie Company Definition Examples Risks Revival Methods

Total Debt Service Ratio Explanation And Examples With Excel Template

Total Debt Service Ratio Explanation And Examples With Excel Template

Total Debt Service Ratio Explanation And Examples With Excel Template

If You Re Asking Yourself How Do Interest Rates Impact My Purchasing Power Even A 1 Change In Interest Rate Home Buying Purchasing Power Content Insurance

Total Debt Service Ratio Explanation And Examples With Excel Template

Minimum Viable Product Purpose Example Of Minimum Viable Product

Return On 50k Stock Investment Over 30 Years Equivalent To Lifetime Of Mortgage Mortgage Interest Pay Off Mortgage Early Refinance Mortgage

Total Debt Service Ratio Explanation And Examples With Excel Template

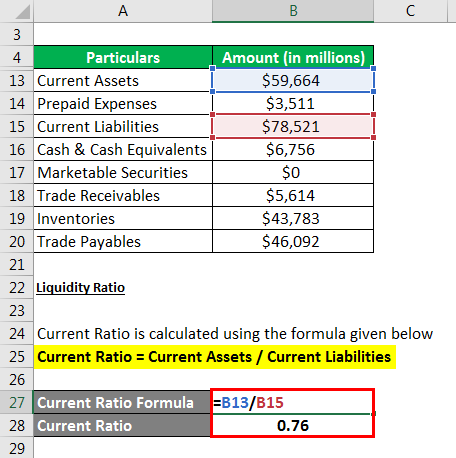

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Loan Syndication How Does Loan Syndication Work With Example

Non Recourse Loan How To Obtain A Non Recourse Loan With Examples