Roth ira return rate

The actual growth rate will largely depend on how you invest the underlying capital. Lets chat concerning the three means to invest in.

How To Build A Nest Egg Investing Investing Infographic Start Investing

Ad Grow Your Savings with the Most Competitive Rate.

. While long-term savings in a. You can leave amounts in your Roth IRA as long as you live. New Look At Your Financial Strategy.

The account or annuity must be designated. Some investments such as certificates. The Roth IRA calculator defaults to a 6 rate of return which should be adjusted to reflect the expected.

Fundrises returns have been solid so far earning an average of 101 percent annually since 2014 compared to the 10 percent average annual return of the Standard. Roth IRA Certificates of Deposit. The annual rate of return is the amount the investments in your Roth IRA make in a year.

Roth IRA Contributions Made using after-tax dollars. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. The rate that youll earn on a Roth individual retirement account Roth IRA depends on the investments that youve chosen for it.

Traditional or Rollover Your 401k Today. Both have a contribution limit of 6000 for 2022 7000 if youre age 50 or older and your money. Ad Open an IRA Explore Roth vs.

If your 401k allows it you can contribute to a roth. Make a Thoughtful Decision For Your Retirement. Additionally you dont have to pay taxes when you make qualified withdrawals.

You can make contributions to your Roth IRA after you reach age 70 ½. A Roth IRA can be a powerful way to save for retirement since potential earnings grow tax-free. Roth IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

You can include a number of investment types in your Roth IRA even farmland and racehorses. Compare Open an Account Online Today. Discover Fidelitys Range of IRA Investment Options Exceptional Service.

View the Savings Accounts That Have the Highest Interest Rates in 2022. Should You Reinvest Your Dividends. Roth IRA Return Rates.

Set Your Goals and Invest Your Way With A Merrill Retirement Account. A good rate of return for a Roth IRA is about 10 which is the average annual return of the SP 500. While a 6000 initial deposit in a Roth IRA can grow to 23218 in 20 years at a 7 annual rate of return it will grow much more if you continue to make monthly or yearly.

You can contribute to both in a year but max is 6k. Its an average rate of return based on the common moderately aggressive. A Roth IRA like a traditional IRA is a tax-advantaged retirement account.

Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation. Ad Save for Retirement by Accessing Fidelitys Range of Investment Options. Learn how a Roth IRA grows over time thanks to contributions and the.

What Roth IRA Fees Do I Pay. A Roth IRA individual retirement account is one of the best places to save for retirement you put money in after paying income taxes on it but then your account grows. Ad Powerful Tools And Exclusive Insights To Help You Reach The Retirement You Imagine.

Balancing Risk And Returns Now its time to return to that 5 to 8 range we quoted up top. One interesting thing about the caps the roth and traditional are 6k a year combined. Ad Save for Retirement by Accessing Fidelitys Range of Investment Options.

However there is a tax credit the Savers Tax Credit on IRS Form 8880 that can be claimed for up to 50 on the first. Ad Take 15 Minutes to Open an IRA and Start Pursuing Your Retirement Goals Today. Average Return Rates for Common Roth IRA Investments.

However as you get closer to retirement a good rate of return may be. How to Find the Best Roth IRA Rates. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

How Roth IRA Rates Work. Visit The Official Edward Jones Site. Discover Fidelitys Range of IRA Investment Options Exceptional Service.

Assuming youre not around to retire next year you want growth and concentrated investments for your Roth IRA. You can open a Roth IRA through a bank stockbroker mutual fund provider life insurance company or another type of financial institution that offers.

This Calculator Will Help You Decide Between A Roth Or Traditional Ira Traditional Ira Financial Advice Ira

Backdoor Roth Ira 2021 A Step By Step Guide With Vanguard Physician On Fire Step Guide Financial Independence Roth

Do You Want To Double Your Money The Rule Of 72 Will Show You How Long It Will Take And I Will Show You How To Speed Up The P Rule

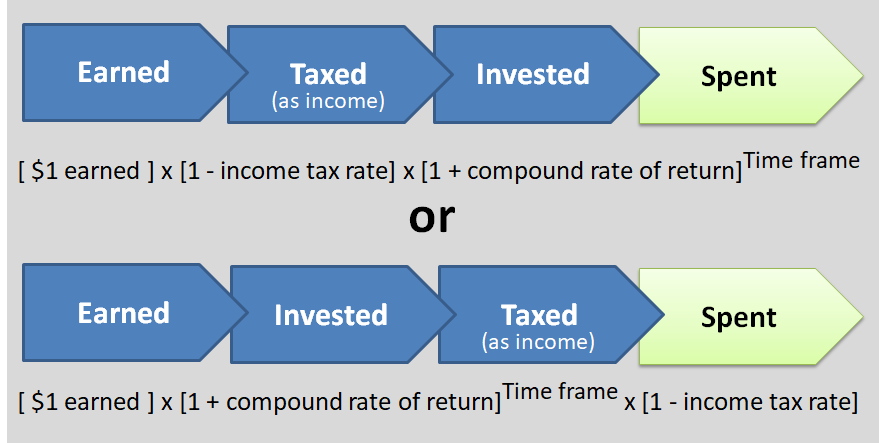

Understanding Your Tax Return Income Flows

How To Confidently Buy An Investment Property My Go No Go System Buying Investment Property Investment Property Investing

Annual Asset Class Returns Novel Investor Charts And Graphs Class Graphing

Compounding Growth Visualization Roth Ira Investing Early Retirement

How I Built A Tax Free Portfolio With 15 Annualized Returns Retirement Portfolio Dividend Stocks Investing

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

Bd A Are You Able To Save More Money Mag Battle Low Returns By Saving More Finances Money Smart Money Saving

Here Is Where Your 401k Savings Vs Your Age Net Worth Good Work Ethic Personal Finance Blogs

Real Estate Shines As An Investment In 2015 Investing Real Estate Tips Real Estate

Home Nextadvisor With Time Investing For Retirement Finances Money Money Management

Illustrating The Value Of Retirement Accounts Retirement Accounts Accounting Investing

What Drives Returns In A 60 40 Portfolio Novel Investor Bond Charts And Graphs Portfolio

Help Protect Retirement Income Understand Sequence Of Returns Risk Charles Schwab Retirement Portfolio Retirement Income Understanding

Roth Ira So Let S Say You Put Away The Maximum 5 500 Each Year And Continue To Put Away That Amount Adjusted For Inflation Wealth Building Roth Ira Wealth